pa educational improvement tax credit election form

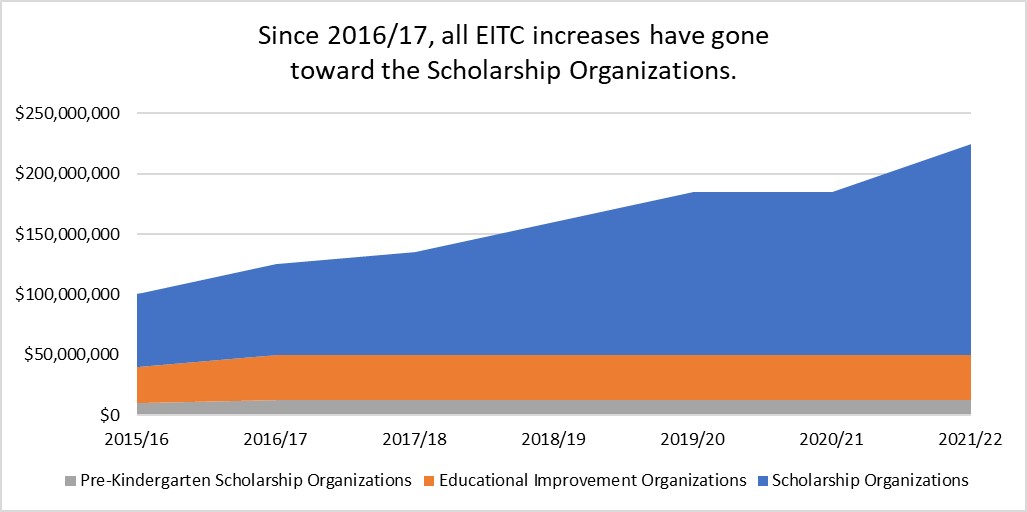

Applicants interested in applying as an Educational Improvement Organization Scholarship Organization or Pre-K Organization can apply at DCED Center for Business Financing Tax Credit Division 4th Floor Commonwealth Keystone Building 400 North Street Harrisburg PA 17120. Pennsylvanias Educational Improvement Tax Credit program helps tens of thousands of students access schools that are the right fit for them but policymakers could do more to expand educational opportunity.

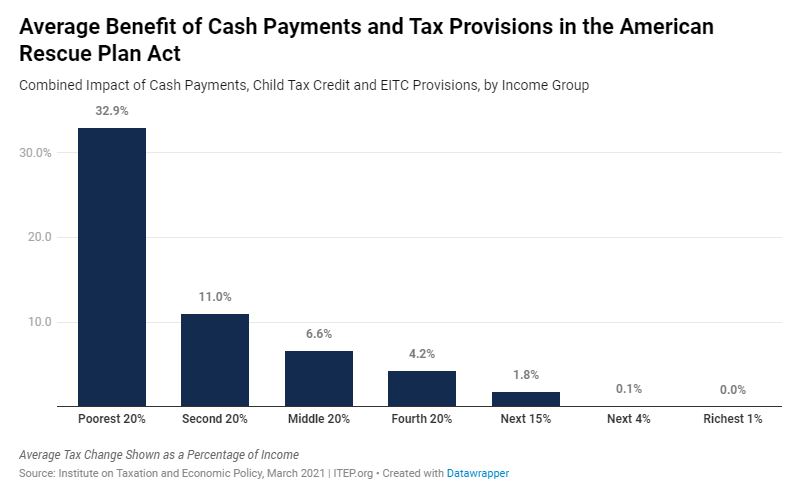

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

A separate election must be submitted for each year an EITCOSTC is awarded.

. The Educational Improvement Tax Credit is a program of the Commonwealth of Pennsylvania administered through the Department of Community and Economic Development that allows eligible businesses to apply tax credits against their tax liability for the year in which the contributions were made. Eligibility for the scholarships is limited to students from low- and middle-income families. May 16 Business applicants who have fulfilled their 2-year commitment and wish to reapply in FY 2223 to renew their 2-year commitment.

Election to apply unused EITCOSTC to the tax liability of the owners in the taxable year immediately follow-ing the year in which the contribution is made. PO BOX 280701 HARRISBURG PA 17128-0701. Contributions provide financial aid to families of current students.

The State of Pennsylvania allows a tax credit equal to 75 of any. How Do PA Educational Tax Credits Work. Do not use the Single Application.

Our mission is to improve the quality of life for Pennsylvania citizens while assuring transparency and accountability in the expenditure of public funds. A Pa SPE K-1 will be provided by mail in February so the donor has proof of their eitc tax credit. To pass through an Educational Improvement or Opportunity Scholarship Tax Credit complete and submit form REV-1123 Educational ImprovementOpportunity Scholarship Tax Credit Election Form.

PA Educational Improvement Tax Credit Users You Have a Voice. Identification Number Revenue ID FEIN SSN. Proposed IRS rules could create problems for participants in the PA EITC program.

Download File Educational Improvement Tax Credit Program EITC Guidelines. DO N O T I NC Lu DE ThI S E LE CT IO N WI Th y Ou R T Ax REP OR T. But that doesnt mean that the proposal from House Speaker Mike Turzai R-Allegheny is going to disappear anytime soon.

A complete form OC is also required. Employer Annual W2-R Form. Our mission is to improve the quality of life for Pennsylvania citizens while assuring transparency and accountability in the expenditure of public funds.

Businesses can apply for a tax credit of up to. Department Use Only Address. EDUCATIONAL IMPROVEMENT PO BOX 280604.

A se pa r a te e le ct io n mu st be s ub mi tt ed fo r ea ch ye ar an E IT C OS T C is a w ar de d an d no t us ed in wh ol e or in p ar t by th e con tr i bu ti ng e nt it y. The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational improvement organizations in order to promote expanded educational. Irrevocable election to pass Educational Improvement Tax Credit EITC through to shareholders members or partnersA separate election must be submitted for each year an EITC is awarded and not used in whole or in part by the contributing entity.

Of Educational Improvement Tax Credit EITC or Opportunity Scholarship Tax Credit OSTC awarded to a pass-through entity or special purpose entity along with the amounts of the EITC or OSTC to be passed through to the. Department in the form of a written acknowledgment letter from La Roche University within 90 days of. Foundation listed as SPARKS Foundation on the list of approved organizations is approved as an Educational Improvement Organization EIO as defined by PAs Educational Improvement Tax Credit Program EITC.

About 73 percent of Pennsylvania students. Pennsylvania high schools where qualified juniors and seniors have the opportunity to take. Tax credits to eligible businesses contributing to a Scholarship Organization an Educational Improvement Organization andor a Pre-Kindergarten Scholarship Organization.

Invest in Philadelphia children while lowering your state and federal tax liability through the PA Opportunity Scholarship Tax Credit OSTC and the PA Educational Improvement Tax Credit EITC. HARRISBURG PA 17128-0701 EDUCATIONAL IMPROVEMENT TAX CREDIT ELECTION FORM See Page 3 for instructions. Contact our Development Office to learn how you can participate.

REV-1123 -- Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV-1190 -- Tax Worksheet for PA-20SPA-65 Schedule M Part B Section E Line a REV-1849 -- Business Operations Questionnaire. PA DEPArTMENT OF rEVENuE BurEAu OF COrPOrATION TAxES - EITCOSTC uNIT PO BOx 280701. Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV-1123 Pass-Through Entity Name.

This program awards tax credits to businesses that make contributions to qualified Scholarship and Educational Improvement Organizations. EITC OSTC Frequently Asked Questions Learn more about the top asked questions for the Educational Improvement and Opportunity Scholarship Tax Credit. BUREAU OF CORPORATION TAXES.

70 of Philadelphia K-8th grade public schools are on Pennsylvanias list of lowest-performing schools and parents are desperate for better. As indicated in our URGENT blog posts on Monday August 27th based on IRS proposed regulations issued on August 23 2018 payments to charities in exchange for state income tax credits would result. Use the REV-1123 Educational ImprovementOpportunity.

A pass-through EITCOSTC can be applied to all classesof income earned by the owners. The Educational Tax Credits program contains two sections of which credits may be awarded for applicants within the program. The Educational Improvement Tax Credit Program EITC provides a way for the businesses and individuals to be involved with education by directing their tax liability dollars to a school of their choice.

Tom Wolf said Wednesday that he will veto a proposed expansion of Pennsylvanias Educational Improvement Tax Credit which directs millions of potential tax dollars each year to private schools and educational programs. Return the election form to. Irrevocable election to pass Educational Improvement Tax Credit EITCOpportunity Scholarship Tax Credit OSTC through to shareholders members or partners.

List of Educational Improvement Organizations Effective 712015 6302016 EITC. Certified Tax Officers. Individual donors must file a Pa 40 individual or joint tax return for the year and include the 90 payment tax credit on page 2 line 23 other credits.

The Educational Improvement Tax Credit Program Center for Business Financing Tax Credit Division 400 North Street. The Pennsylvania Educational Improvement Tax Credit EITC can be very beneficial to companies conducting business in Pennsylvania by reducing tax liability. Scholarship Tax Credit Election Form to report the amount.

PA Tax Credit Opportunities for Businesses. To pass through a Keystone Innovation Zone tax credit visit the Department of Community and Economic Developments DCED website at dcedpagov or call DCED Customer Service at.

Def 14a 1 Nc10021080x1 Def14a Htm Def14a Table

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

State Policy Budget Issues Pennsylvania Child Care Association

European Flag European Commission Brussels 5 9 2019 Swd 2019 320 Final Commission Staff Working Document Roma Inclusion Measures Reported Under The Eu Framework For Nris Accompanying The Document Communication From The

Fill Free Fillable Forms For The State Of Pennsylvania

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

Tompkins Vist Bank Contributes To Youth Education Organizations Daily Local

Covid 19 Tax Policy Resources Itep

Framing Non State Engagement In Education

Child Health Systems In The United Kingdom England The Journal Of Pediatrics

Country Profiles Of E Governance

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation